Best Mobile Genre for your Next Mobile Project with China Mobile Game Market Data Update [Report]

- Mantin Lu

- Jun 7, 2016

- 2 min read

TalkingData revealed the latest report regarding China mobile game industry benchmark of March and April 2016. The analysis and comparison of data will help to demonstrate a clear trend of the market and provide some insight into the nonstop growing mobile game industry in China. This updated trend reinforced my opinion about the promising mobile game genres in China market, so I would like to give some tips on the genre your team should focus on for your next mobile project.

In April 2016, RPG still stands out of all the game genres for its pay rate. The RPG pay rate keeps stable on the Android platform and increased on the iOS platform from 4.92% in March to 4.95% in April. For both of the platforms, pay rates of other game genres also maintain their ranking with slight changes shown, which are all within 0.1%.

Pay rate of China mobile game genres, April (left) and March (right) (TalkingData 2016)

The top three game genres on average DAU/MAU ranking are Board Game, Card Game, and RPG. Each reaches 0.15,0.15, and 0.14 on Android platform, and 0.17, 0.16, and 0.16 on iOS platform in April. Compared to data from the previous month, the overall trend maintains flat. The top three genres, Board Game, Card Game, and RPG keep stable with a slight increase from 0.15 to 0.16 shown on average DAU/MAU of Board Game on the Android platform.

Average DAU/MAU of China mobile game genres on iOS, April 2016 (TalkingData, 2016)

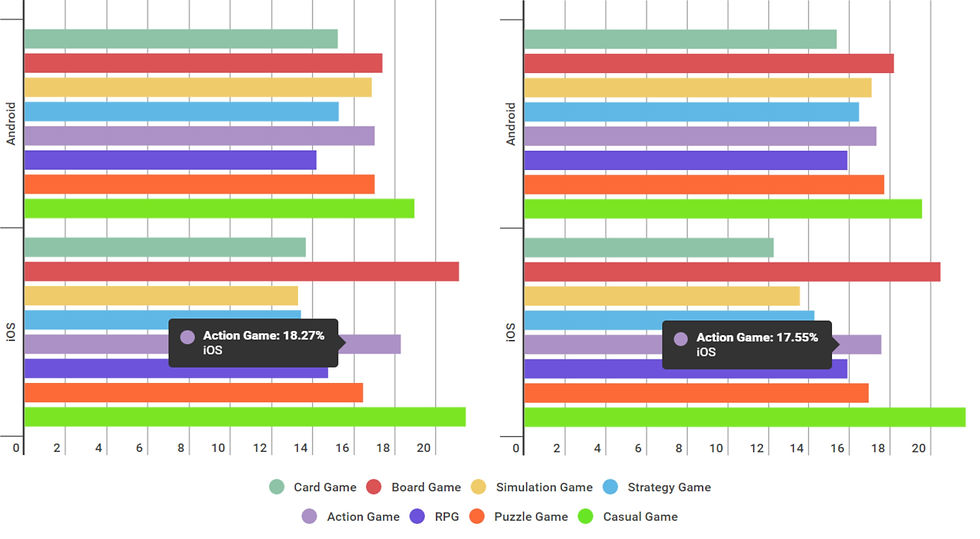

On top of that, a noticeable increase in monthly active user falls to Action Game genre on iOS platform, 18.27% compared to 17.55% in March, while other genres slowed down their growth or even dropped slightly.

Monthly active users of China mobile game genres, April (left) and March (right) (TalkingData 2016)

Day-one retention on both platforms keeps its stable position. The two highlighted growths are Strategy Game and RPG on the iOS platform, each increase from 27.77% in March to 29.39% in April, and 30.35% in March to 30.77% in April.

Day-one retention of China mobile game genres on iOS, April (left) and March (right) (TalkingData 2016)

While the Android platform does not show a good performance on average time spent, the iOS platform has Action Game and RPG holding their growing trend. Each increased from 995 seconds in March to 1,027 seconds in April, and 1008 seconds in March to 1,015 seconds in April.

Average time spent of China mobile game genres on iOS (in seconds), April (left) and March (right) (TalkingData 2016)

The data and analysis above still feature RPG and Action Game as very promising game genres. Meanwhile, Strategy Game and Card Game also give impressive performance compared to other genres. Considering all the factors above including pay-rate, day one retention, stickiness, active user rate, and average time spent, for a mobile game production team to create a new game, my personal first choice is a game with a genre of RPG + Action, and the second choice would be Strategy + Card with some RPG elements.

Research Assistant: Vitani Shan

Comments